Portfolio management is vital for executing long-term strategies as it enables organizations to manage projects, initiatives, and investments in alignment with strategic objectives. A McKinsey research on portfolio optimization suggests that efficient portfolio management allows companies to increase growth-related spending, cut costs, improve margins, and reduce overall business complexity.

This is where measuring a portfolio’s performance comes in. Organizations use portfolio metrics to improve their resource allocation, mitigate risks, and prioritize initiatives that contribute to long-term goals. These metrics help to ensure successful strategy execution and maximize the value delivered by the portfolio.

Let's dive deeper into the definition of portfolio metrics and what are some of the most important ones you should consider tracking.

What Are Project Portfolio Metrics?

Project portfolio metrics are quantitative measurements used to assess the performance of a collection of projects inside an organization. These metrics help stakeholders evaluate the overall effectiveness of their project portfolio as they can make informed decisions regarding resource allocation, project portfolio prioritization, and risk management.

Project portfolio metrics are not only measurable and clear but are also agreed upon and highly transparent to all stakeholders. They are tracked in real-time and are most effective when they measure things that are directly linked to the outcomes that matter the most.

Why Is Tracking Portfolio Management Metrics Important?

Thanks to measuring project portfolio KPIs, portfolio managers can prioritize the initiatives that provide the highest value to the organization and, at the same time, contribute to achieving the organizational goals. Portfolio management metrics should be quantifiable, relevant, outcome-based, and clearly defined. As such, they can help you measure current vs. past performance and derive valuable insights for future actions.

Businessmap is the most flexible software

to align work with company goals

What Are KPIs for Portfolio Management?

Some of the vital key performance indicators (KPIs) for portfolio management include:

- Financial metrics

- Execution metrics

- Operational efficiency metrics

- Business value metrics

- Risk assessment metrics

Let's take a look at some examples.

Financial Metrics

The financial category includes metrics such as budget variance and net present value (NPV) which can assist stakeholders in optimizing resources and making informed investment decisions.

-

Budget variances: Budget variances indicate the difference between estimated and actual costs allocated for specific activities or projects within the portfolio.

-

Net present value (NPV): Net present value (NPV) is a portfolio metric that calculates a project's expected cashflow against the initial investment indicating the project's potential profitability and value.

Delivery Metrics

Portfolio execution or delivery measurements are used to evaluate the progress and performance of projects within a portfolio. They focus on tracking the timely and successful completion of projects. Examples of portfolio execution metrics include project delivery success rate, project completion rate (throughput), on-time delivery, and schedule variance.

-

Project completion rate: The completion rate of projects within a portfolio is the ratio of projects that are successfully finished compared to the total number of projects. It provides a measure of how many projects are completed within designated timeframes and budget constraints.

-

On-time delivery rate: The on-time delivery rate is a project portfolio metric that measures the percentage of projects completed within their scheduled deadlines and shows the ability to meet time constraints.

-

Schedule variances: Schedule variance is a project portfolio metric that quantifies the deviation between the planned schedule and the actual progress of projects, providing insights into whether projects are ahead or behind schedule.

Operational Efficiency Metrics

These metrics focus on evaluating the effectiveness and efficiency of processes and operations within the portfolio. They provide insights into resource utilization, productivity, capacity allocation, and overall operational performance.

-

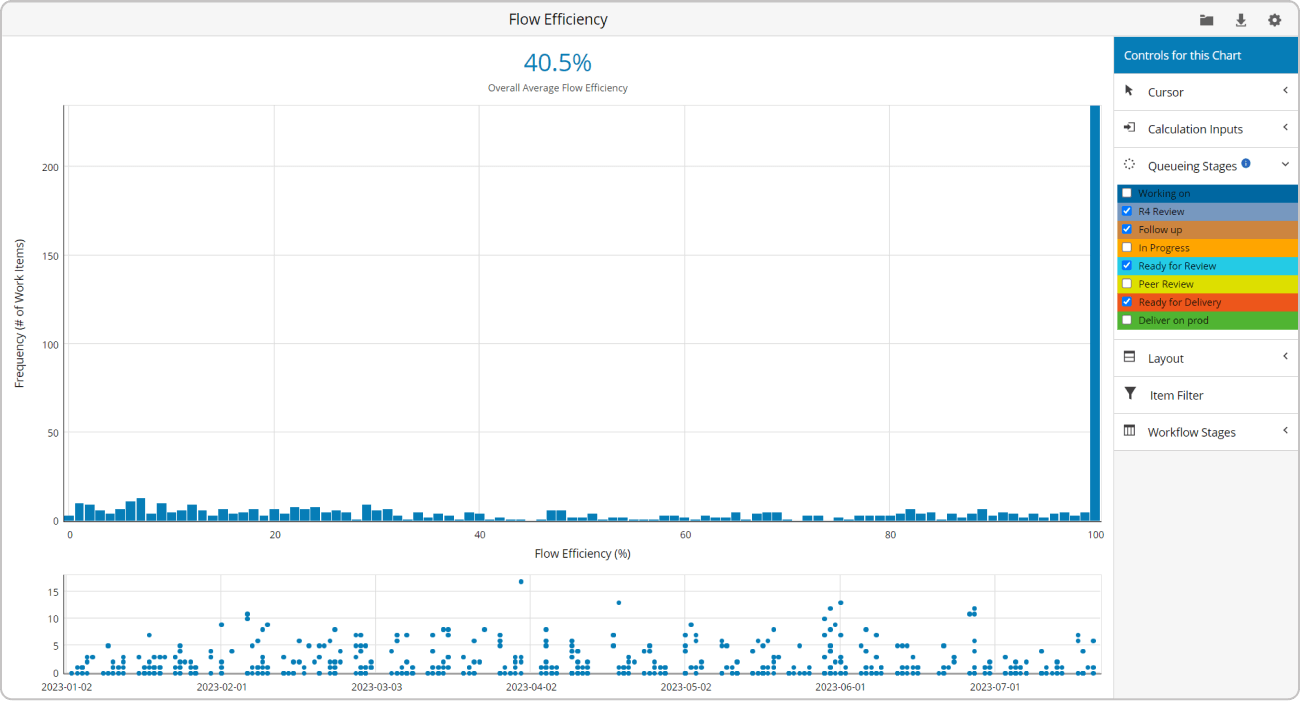

Project flow efficiency: Monitoring project flow efficiency shows how long people have been actively working on a project vs. how long they were waiting on external factors to resume their work. By optimizing every workflow, teams can improve their overall performance, complete more projects, and improve their on-time delivery rate, leading to increased efficiency of the overall portfolio execution.

Measuring the workflow efficiency of a project

Measuring the workflow efficiency of a project

-

Resource utilization: Resource utilization is a portfolio metric that measures the load on resources across projects. It's important for managers to understand whether they're allocating resources in the most efficient way to decrease the likelihood of cost or timeline overruns. Furthermore, tracking capacity across projects helps make informed re-allocation decisions to increase efficiency across most priorities.

Business Value Metrics

Arguably, the most impactful metrics evaluate the value delivered by projects within the portfolio. Business value metrics assess the impact of projects on the organization's bottom line, market position, and overall business objectives. By keeping track of ROI, customer satisfaction, and realized business value, organizations can effectively prioritize the projects that bring the highest value. Furthermore, understanding how many of the completed projects have contributed to the execution of specific strategic initiatives measures your overall strategic alignment.

-

Return on investment (ROI): ROI assesses the financial gain or loss relative to the investment made in the portfolio, indicating the profitability created by the portfolio.

-

Customer satisfaction: Customer satisfaction reflects how the product or service we deliver meets the customer expectations through the use of surveys, net promoter scores, etc.

-

Realized business value: Realized business value refers to the tangible and measurable outcomes, benefits, or returns achieved by executing projects within the portfolio.

Risk Assessment Metrics

Risk assessment project portfolio metrics help in managing the potential risks associated with projects within a portfolio. Metrics such as risk exposure, risk severity, and risk probability can be used to identify and quantify risks to mitigate them on time.

-

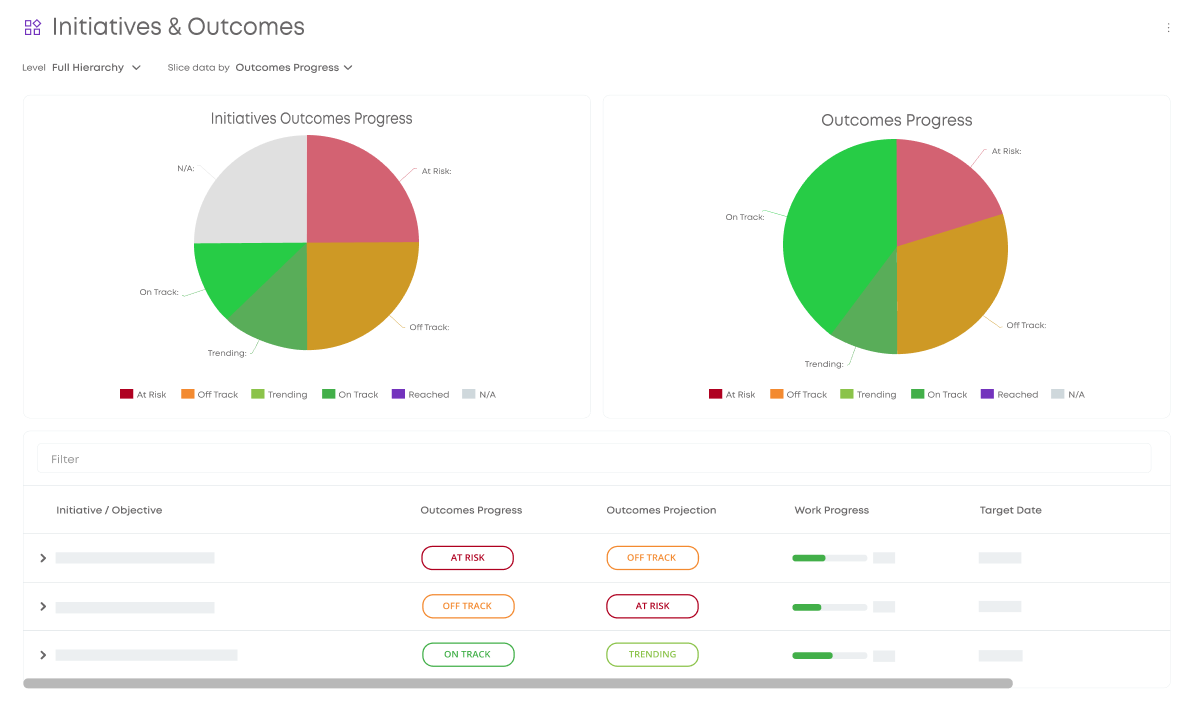

Risk probability: Assessing a project’s risk probability allows portfolio managers to see what's projected to be at risk or off track based on current work progress. The same is true for the progress of outcomes defining your organizational goals.

Monitoring the status across all business objectives to detect risks and warnings

Monitoring the status across all business objectives to detect risks and warnings

-

Risk severity: Risk severity or risk impact indicates the expected harm due to exposure to risk. Risk severity levels are usually represented using an ordinal scale where factors such as size and complexity affect the actual risk severity ranging from “negligible” to “maximum” level.

How To Set Up Your Portfolio for Performance Measurement?

Measuring portfolio management in practice involves a systematic approach that should be ongoing and iterative. Here are the five essential steps to effectively evaluate your project portfolio.

-

Define Measurement Objectives: Clearly identify the objectives of evaluating your portfolio. Determine the specific aspects of portfolio management that need to be measured, such as financial performance, risk management, stakeholder satisfaction, or operational efficiency.

-

Select KPIs: Identify and choose the appropriate KPIs that align with the defined measurement objectives. KPIs should be measurable, relevant, and directly linked to the desired outcomes of portfolio management. Consider a mix of quantitative metrics (e.g., financial metrics, delivery metrics) and qualitative metrics (e.g., stakeholder or team satisfaction).

-

Collect Data: Gather relevant data to measure the selected KPIs. Data can come from various sources, such as project reports, financial statements, risk registers, stakeholder surveys, or operational performance metrics. Ensure data accuracy and reliability by using standardized data collection methods and tools.

-

Communicate Results: Present the measurement results in a clear and concise manner to stakeholders, including senior management, project teams, and relevant decision-makers. Foster a culture of transparency and accountability in sharing the measurement results.

-

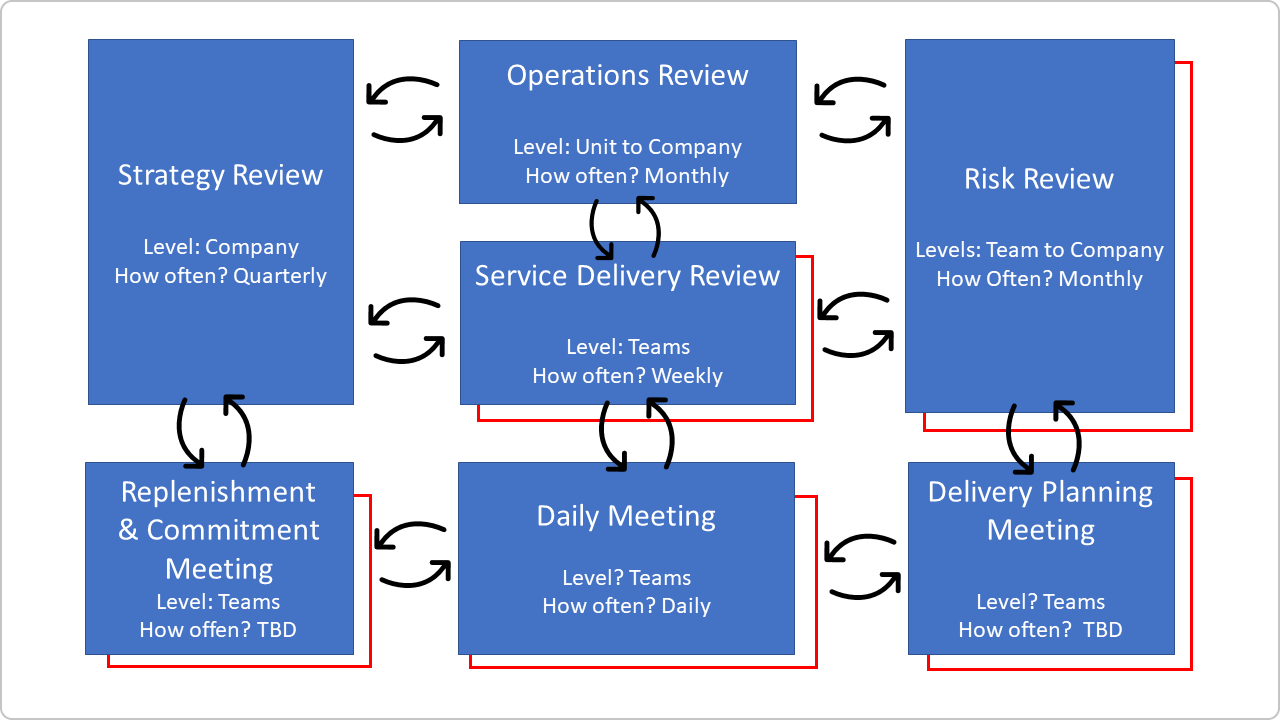

Continuously Review and Improve: Frequent evaluation of project and initiative progress showcases their alignment with strategic goals. Based on the results, portfolio managers can take appropriate actions to address gaps, improve performance, and enhance their portfolio management approach. For instance, incorporating regular reviews such as cadences across an organization can enhance the flow of information across the company so everybody is on the same page about the most important portfolio metrics.

Regular review meetings across an organization

Regular review meetings across an organization

Businessmap is the most flexible software

to align work with company goals

In Summary

Project portfolio metrics provide a way for organizations to inspect their performance, evaluate and make data-driven decisions in the process of achieving business goals. The most used types of portfolio metrics include:

- Financial metrics

- Execution metrics

- Operational efficiency metrics

- Business value metrics

- Risk evaluation metrics

Measuring the workflow efficiency of a project

Measuring the workflow efficiency of a project Monitoring the status across all business objectives to detect risks and warnings

Monitoring the status across all business objectives to detect risks and warnings Regular review meetings across an organization

Regular review meetings across an organization